Do you feel overwhelmed by the financial aspect of your business’s e-commerce venture? Bookkeeping is a key factor in the success of an online store. It provides accurate information on all transactions, sales made, expenditures incurred and tax due. In terms of accounting reports and tax returns, filing them at the end each year and tracking the cash flow, bookkeeping is very beneficial.

The success of an e-commerce company requires more than just great products and marketing strategies. Behind the scenes, a meticulous control of finances plays a key function in ensuring that the business is profitable and compliance. In this post, we’ll examine the most important elements of financial management for ecommerce such as bookskeeping, tax preparation and accounting. Learning and mastering this component is vital for sustainable growth in today’s competitive e-commerce business environment.

Bookkeeping is a crucial aspect of the financial management of ecommerce companies. Bookkeeping involves organizing and recording financial transactions, such as sales and expenses. By keeping accurate and current data, entrepreneurs of e-commerce gain valuable insights into their company’s financial health. They can track the flow of cash and keep track of expenditures and sales. For more information, click accounting

Any business that is involved in eCommerce require effective bookskeeping practices. Here are some of the most important strategies for streamlining your bookkeeping procedures:

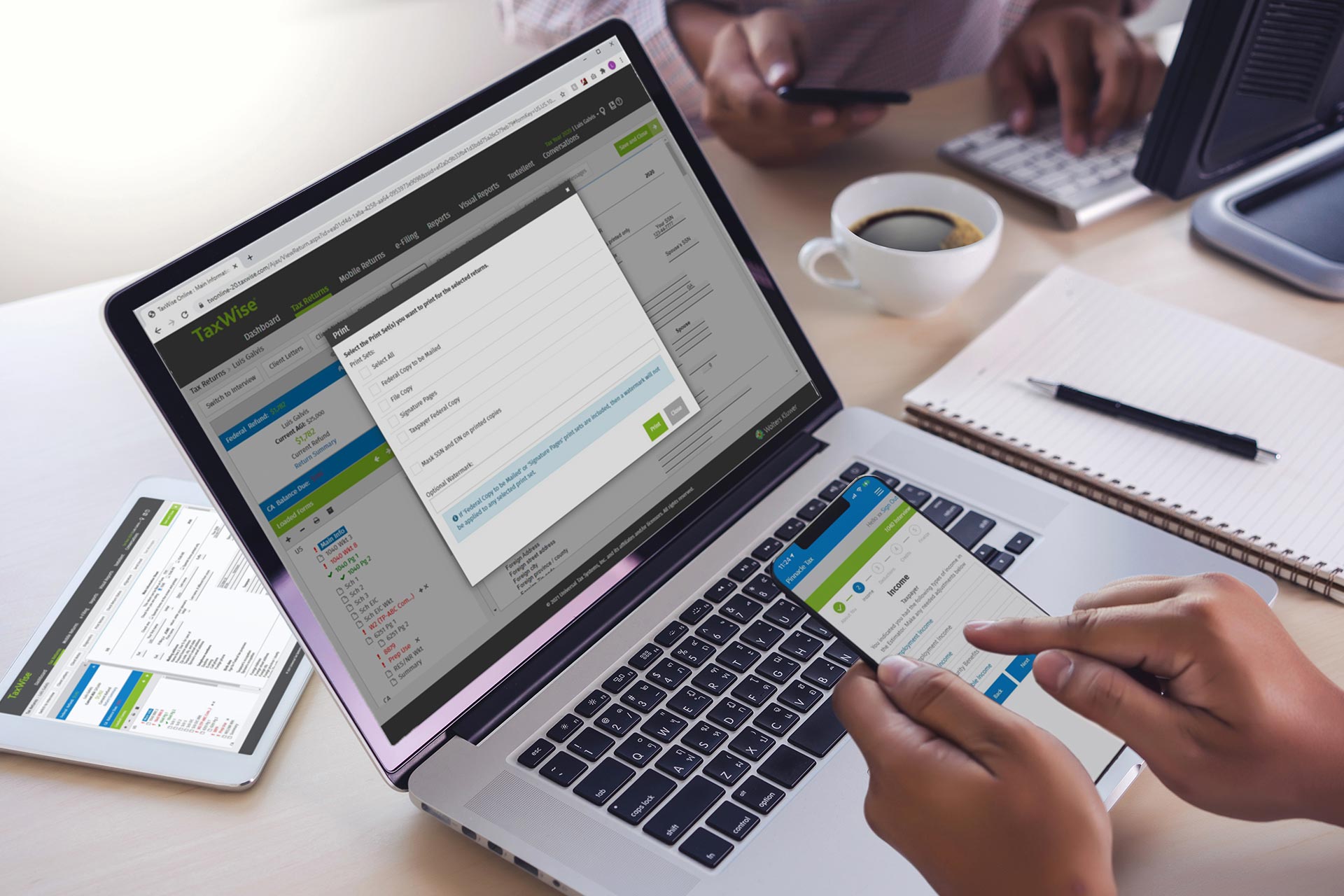

Accounting Software: Use accounting software that is specifically designed for ecommerce. These software tools can automate the input of data produces reports, and allow integration with payment gateways, e-commerce platforms and ecommerce platforms.

Separate your personal finances from those of your company. It is vital to separate your banks, credit cards and debit cards. This helps streamline bookkeeping, simplifies tax preparation, and guarantees accurate financial reporting.

Tag transactions with precision: By classifying your transactions you will better understand your income streams. Create categories for advertising costs, shipping charges, and other expenses.

Tax preparation is a crucial aspect of financial management E-commerce. Tax regulations should be followed by companies that sell online. They have to pay and collect sales tax where necessary and prepare tax returns in a timely manner. Here are some considerations for tax preparation that are effective:

Sales Tax Compliance: Know the tax laws of the jurisdictions in which you offer your products. It is important to know whether you have nexus or have a significant presence in these states. If you do, you’ll be required to collect sales tax, and then pay it.

Maintain accurate documentation: Maintain meticulous documentation of all your tax-related transactions. This includes expenditures, sales, and other financial transactions. Documentation of tax deductions or exemptions may also be required.

Get an expert on taxation for ecommerce The taxation of Ecommerce is intricate. Contact a tax professional that knows about e-commerce to ensure that your tax return is correct and in compliance.

Accounting extends beyond tax preparation and bookkeeping. It includes analyzing financial information in the form of financial reports as well as providing an overall overview of your company’s performance. Here’s why accounting is essential:

Accounting Analysis: Using accounting, you can analyze your ecommerce business’s financial performance, assess profitability, identify patterns, and take informed decisions to grow.

Budgeting, Forecasting, and Financial Goals: Accounting allows you to create budgets and set financial targets, as well as forecast future performance. This lets you manage resources efficiently.

Financial Reporting: Creating financial statements such as balance sheets, income statements, and cash flow statements, lets you communicate your business’s financial position to stakeholders, investors, and lenders.

As your company grows it becomes more difficult to manage complex financial tasks. outsourcing bookkeeping or accounting provides a number of advantages.

Expertise and accuracy Professional bookkeepers and accountants are experts in the field of e-commerce financials. They are able to provide accurate accounting and financial reports.

Cost and time savings: Outsourcing lets you focus on core business operations while professionals take care of your financial tasks. Outsourcing can be more cost-effective as compared to hiring staff internally.

The implementation of a reliable bookkeeping system for your online store is critical towards helping increase your profits. While it may be time consuming and intimidating to establish a bookkeeping system that allows you to track the expenses. Also, you’ll gain useful insights into areas in which can improve efficiency or boost sales. A professional accounting firm will be able to assist you set up a robust bookkeeping program that puts your business in the ideal position possible for continued success. If you are feeling overwhelmed or do not have the necessary resources available and need help, seek out assistance from a dependable service. It could open up an entire new world of possibilities that can help your business in a variety of ways today and in the long run. What are you waiting for? Utilize these vital sources today and utilize them to increase your business’s profitability as never before!